What Sustainability Attributes Drive Food & Beverage Purchases?

When brands focus on immediate, personal benefits, that tends to work better than broad, complex claims.

The infamous sustainability say-do gap can be frustrating for brands trying to be forces for good in the world.

For example, research from Public Inc. finds that "76% of Canadians and Americans say they are conscious consumers, but only shop their values 38% of the time."

Yet this gap shouldn't prompt brands to dismiss conscious consumption.

For one, this still means over one-third of the market makes purchases based on environmental/social/ethical factors. Moreover, this say-do gap creates an opening for brands to fill.

Rather than having to start from scratch in convincing a broad swath of consumers that sustainability is important, brands can tap into this existing demand, with a few tactical tweaks.

As Public Inc. found, there are four key ways to move the needle:

1. Simplify claims: Confusing claims are the top reason why conscious consumers abandon purchases.

2. Highlight present, tangible benefits: When sustainability is presented as providing clear, near-term benefits, like improving your health, that drives purchasing more than vague, far-off claims like improving life for future generations.

3. Include more than the most sustainable consumers: It might seem that zeroing in on consumers who consistently make sustainable purchases is a winning strategy, but that leaves out a broader target market that can still be won over, such as by focusing on near-term benefits.

4. Focus on "me" not "we": Related to focusing on why a purchase provides benefits now, brands can capture more consumers when talking about how these products directly benefit the purchaser, not the general public. For example, claims like "We never use antibiotics, synthetic hormones, or toxic pesticides" perform better than "carbon neutral."

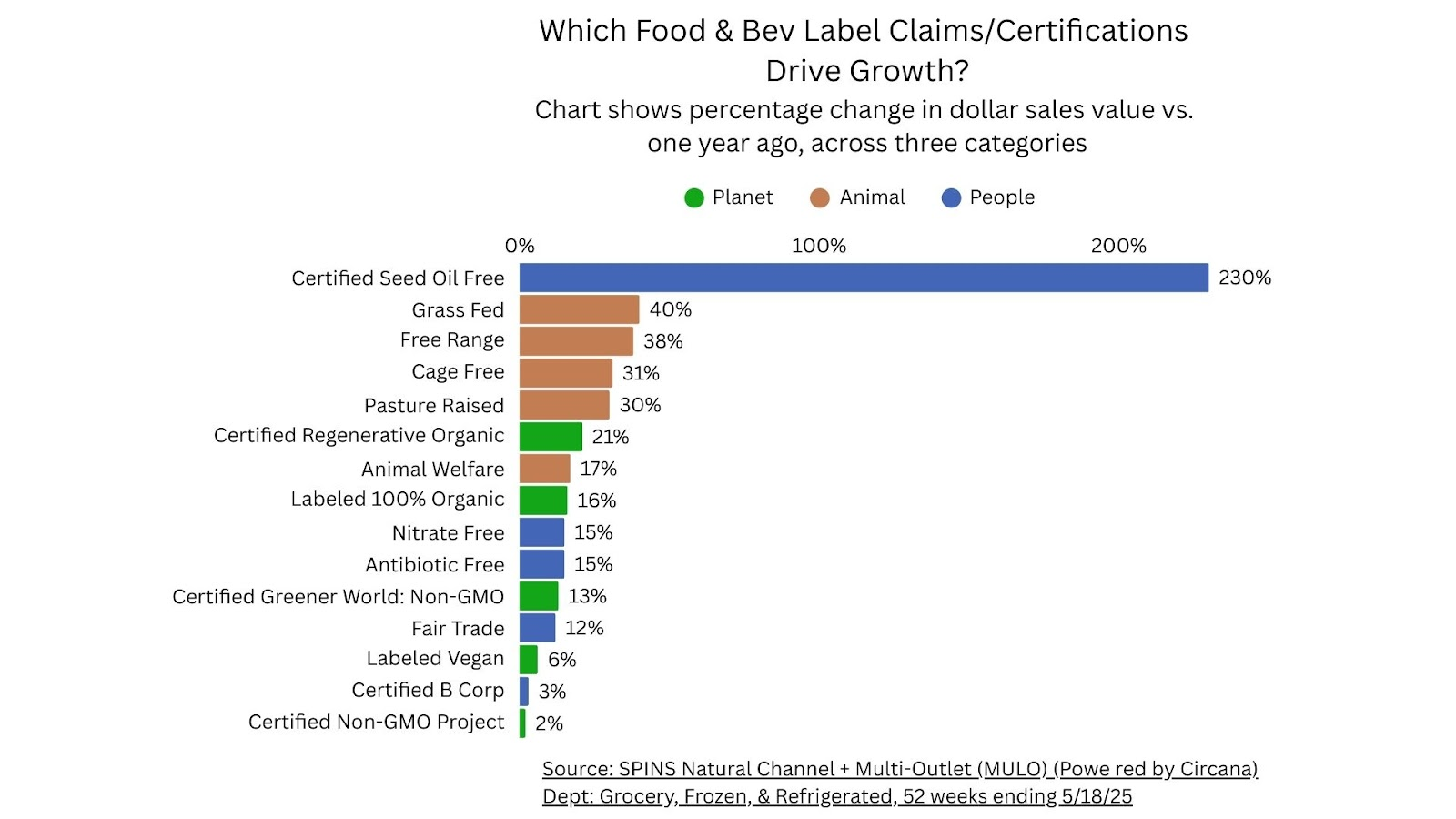

Top Performing Food and Beverage Claims/Certifications

Additional research from SPINS supports Public Inc.'s findings in terms of how simple label claims or certifications that provide clear benefits to individuals tend to drive more sales growth than broader ones.

While part of the yearly growth has to do with the maturity of the labels/certifications, it seems like those related to health and well-being are clear winners. Granted, these don't necessarily all tie directly back to environmental/social/ethical factors, but there's a lot of overlap.

For the record, my non-nutritionist opinion is that seed oil concerns are overblown, but the explosive growth of Certified Seed Oil Free shows that speaking to current health concerns does work. In comparison, the GMO concerns that seemed to be more commonplace a decade or two ago aren't as in vogue, and those certifications aren't driving sales as much.

The growth in animal-related claims is also interesting. While it might seem like these speak to broader benefits, these don't necessarily contrast with Public Inc's findings, because I think a lot of consumers interpret these claims with a subtext of being healthier.

Other health-related claims like nitrate free and antibiotic free don't show quite as much growth, perhaps due to the maturity of these claims, but it's interesting that these still perform better than certifications like for B Corps, where it's not abundantly clear how the consumer benefits.

That's not to say brands should abandon certifications like B Corps. For myself, this is a huge purchase driver. But if companies want to close more of the say-do gap, they need to not only win over people like me who seek out these certifications but also highlight simple, direct benefits, like health and wellness claims.

Granted, there's limited label space, but it's worth noting that Whole Foods research finds 70% of Millennials say they're reading labels more closely than they were five years ago. And as Public Inc. notes, there's room to expand on benefits outside of packaging, such as on social.

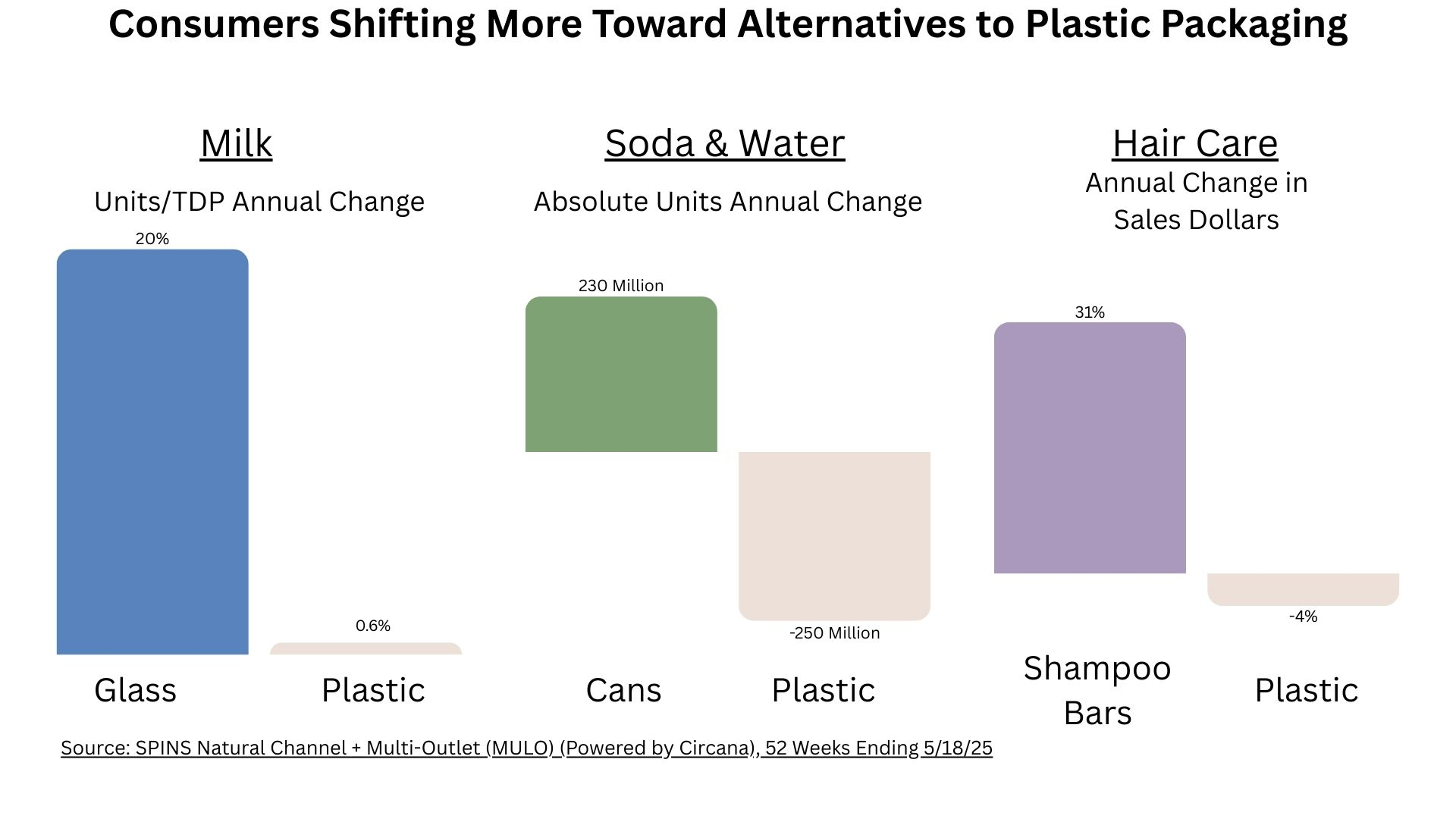

It's not just what you say, either. SPINS research also finds that packaging can be a growth driver. Plastic is often fading, while alternatives like glass and cans are seeing strong growth.

Here too, I think there's a subtext of health. Sometimes plastic actually has a lower environmental impact than some other materials, due to factors such as shipping weight, though much depends on factors like reuse and recycling rates. Still, a lot of consumers simply do not want to consume products from plastic containers due to health concerns.

Altogether, these trends signal to food and beverage companies that while many consumers want to make planet-positive choices, purchasing decisions are often first filtered through their own consumption lenses.

Brands need to focus on why environmental and social practices help buyers in that moment, not just in the long run. By making sustainability more personal, it could be easier for shoppers to see that it's worth opening up their wallets.